what happens to my credit score when i pay off my credit cards

How Much Volition My Credit Score Increase After Paying Off Credit Cards?

By Lauren Bringle, AFC®

When it comes to raising your credit score, lowering your debt is a good idea. Paying off a credit card is a pace in that direction considering the corporeality y'all owe counts for 30% of your FICO® score.

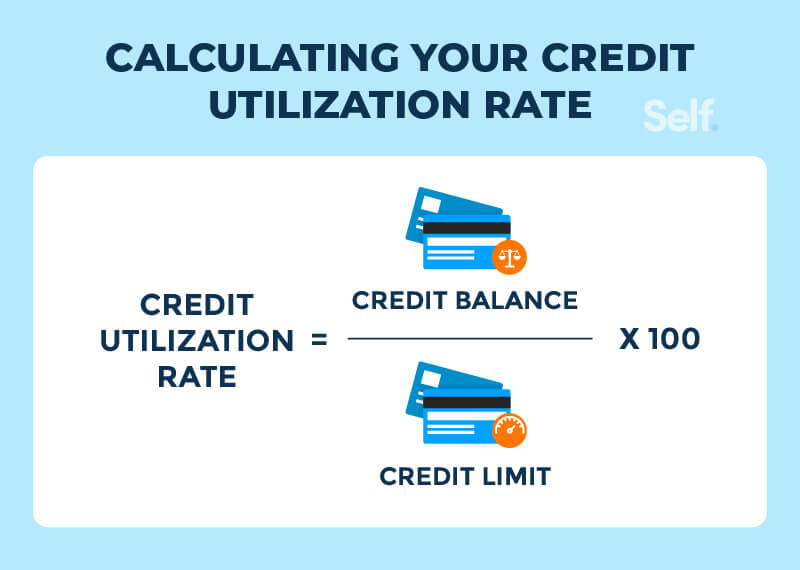

However, it's not simply the amount y'all owe that matters. It'due south how much y'all owe in relation to your total credit limit. This is known as your credit utilization ratio.

The simplest way to put information technology is: Paying off your credit menu, or lowering your balance, volition decrease your credit utilization rate, which can assist increase your credit score.

What impacts my credit score?

The FICO® arrangement and the VantageScore arrangement weigh v factors in determining your credit score, but they evaluate each factor slightly differently.

FICO®'s method is widely used by lenders when determining credit risk, so we'll look at how credit scores are calculated beneath.

- Payment history (35%): Your payment history reflects your on-fourth dimension payments and whatever missed or late payments.

- Amounts owed (thirty%): Your credit utilization ratio is how much you owe compared to your overall credit limit.

- Credit history length (15%): The longer y'all maintain good payment history, the better this category will wait.

- Credit mix (10%): The variety of credit you have in your credit profile. For instance, since installment loans and credit cards work differently, having both in your credit history may indicate you're better able to manage credit.

- Recent activity (ten%): If yous apply for too much credit during a curt period, this could indicate you're a greater credit risk.

What happens to my credit score when I pay off my credit card in full?

Your credit score volition likely rise if you pay off your credit card because your credit utilization ratio decreases. All the same, how much your credit utilization ratio drops depends on where it began. For example, it's more than pregnant to pay off $1,000 in debt when your credit limit is $i,200 than when your limit is $10,000.

Say your credit utilization rate is high, and you lot pay off a high-limit credit card. That would assist your credit score more paying off a high-limit card when you lot don't owe much.

Let'south revisit our earlier example of three credit cards with a total credit limit of $3,000 and combined debt of $1,200. Imagine yous owe $500 on a bill of fare that has a $1,000 credit limit, and you pay it all off. That reduces your total debt to $700 and brings your credit utilization ratio down to 23%, which is a significant drop from where information technology get-go was (40%).

Imagine, however, that you decide to shut that credit card after you lot paid it off. Then, you'd have an overall credit limit of $two,000 merely the same total debt of $700. In that example, your credit utilization ratio would exist 35%.

It's improve, therefore, to keep your credit accounts open as long as yous can use your credit cards responsibly.

How much will my credit score increase after paying off my credit card?

This depends on how much your credit utilization ratio changes. Experts concur that it's best to shoot for a credit rate below 30%[i]. Just don't stop at that place because borrowers with the best credit scores accept a credit utilization ratio below 10%[2].

Although your credit utilization ratio counts for 30% of your credit score, any steps to improve it don't happen in isolation. You're also lengthening your credit history, for case. And if you miss a payment, it'due south probable to offset improvements made by paying off a card.

All these factors work together in determining your credit score. How much your credit score goes up afterwards paying off a credit carte depends on how much it changes your credit utilization. But what you're doing to maintain and build your credit in other areas matters, besides.

How long will information technology take for my credit score to amend after paying off my credit cards?

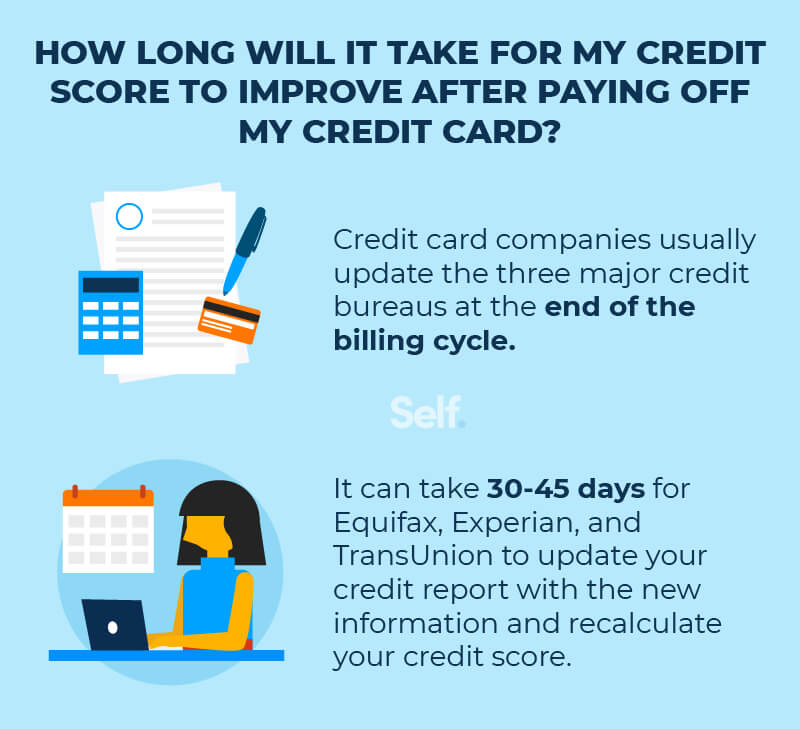

Lenders written report your activity to three main credit bureaus: Experian, Equifax, and TransUnion. This typically occurs at the terminate of each billing cycle.

Payments don't become tardily or delinquent until they're more 30 days past due. By the aforementioned token, it will take 30 or 45 days for whatsoever positive activity, such as paying off a credit card, to appear on your credit study. FICO® and VantageScore use these credit reports in their credit scoring models.

Reasons why my credit score would become down

There are many reasons why a credit score might drib. Here are but a few:

- Yous missed a payment past more than than 30 days.

- Other derogatory marks such equally bankruptcy, repossession, or foreclosure.

- You practical for a new credit carte du jour, car loan, or other line of credit, triggering a hard inquiry.

- Your credit card balances have gone up, increasing your credit utilization ratio.

- You recently paid off a loan, narrowing your credit mix or reducing the boilerplate historic period of your accounts.

- Your overall credit limit has gone downwardly, which could happen if:

- You closed a credit card account.

- A lender has lowered your credit limit based on factors such as a change in your income, credit history, or credit score.

Say your credit card limit is reduced, merely your residual remains the same. In that example, your credit utilization rate will be higher.

Other factors include errors in your credit study and fraud or identity theft. Mistakes happen more than frequently than you might think, with i report revealing at least one error on more than than 34% of credit reports[iv].

Using your credit menu wisely

There are many ways to keep your credit in good continuing and potentially authorize for lower interest rates.

- Make your payments on time. This is the most important matter you lot tin can practise since it counts for the biggest chunk of your credit score. Creating a comprehensive budget and setting up automatic payments from your financial institution can help ensure you're never tardily.

- Don't charge more than than you demand. Keeping the balances on your credit cards depression enables you to maintain a low credit utilization rate. This volition come in handy when qualifying for loans and low interest rates on major purchases, such as a car or dwelling house or a personal loan for major repairs.

- Utilize your menu for daily purchases. Using your credit card for everyday needs, so paying it off at the end of each month, builds your credit. Plus, yous can earn rewards or cash dorsum with your purchases.

- Don't just pay the minimum amount. Each month, your credit carte du jour company will consequence a statement with the minimum residue y'all owe—a percentage of your full debt on that card. Paying just the minimum tin keep your debt level high considering interest volition continue to accrue; paying more than the minimum volition reduce your principal and the amount of interest you lot're paying.

- Ready up transaction alerts. Getting an alarm on every transaction made with your card will enable y'all to spot and written report fraudulent transactions immediately.

- Lock cards you're not using. Some companies allow y'all to do this as protection against fraud and theft. Y'all can use information technology to your advantage as a manner to go on your account open and preserve your credit utilization ratio rather than closing your card.

Tips to improve your credit score

Hither are some ways to potentially boost your credit score:

- Beginning by getting a free credit report and looking for reasons why you might have bad credit. You're entitled to a costless report from each credit bureau each year under federal police, and you tin study it for belatedly payments and other negative marks.

- If yous find errors or fraud, file a dispute with the credit reporting bureau where you constitute the error. You lot tin can do then online, by mail service, or past phone.

- Limit loan applications. If you're shopping around for a domicile or machine loan, so all your applications volition count as merely 1 hard research—every bit long equally they're done within a short time. Try to complete this process within 30 days to avoid multiple difficult pulls. Learn more about credit inquiries hither.

- Resolve late payments immediately. In a perfect earth, you lot'll make all your payments on time. If you miss i, don't delay paying information technology off. Each thirty-day menstruation that yous're tardily counts as a negative marker confronting your credit.

- Be cautious nigh moving debt around. In that location are advantages to consolidating loans, such equally simplifying and potentially reducing the size of your payments. Nevertheless, consolidating debt tin can hurt your FICO® score by narrowing your credit mix. Besides, it doesn't eliminate debt and may actually proceed you in debt longer. Residue transfers with low APRs (annual percentage rate) are attractive, but be sure you can pay the rest earlier the interest rate increases.

- Open up at to the lowest degree 3 accounts. People with loftier credit scores tend to have an average of three open up cards.[5] While having more than open up credit cards increases your total credit limit, y'all still need to manage them well as described to a higher place. Don't employ for them all at once in lodge to avoid the appearance that you won't exist able to pay what you owe.

- If you have poor credit, look for means to re-establish it. Ii ways to practise that are becoming an authorized user on some other person's account or depositing a few hundred dollars to open a secured credit card.

- Get help from a nonprofit credit counseling group. Such groups can help you appraise where you lot stand up and develop a strategy for budgeting and debt management.

Remember multiple factors touch on your credit score

Improving your credit score isn't as simple as paying off one or more than of your credit cards. You desire to go on your credit utilization rate low without losing sight of the other factors that play a part in edifice expert credit.

Develop a comprehensive strategy that involves making on-fourth dimension payments, maintaining a good credit mix, resolving whatsoever late payments immediately, and applying for new credit mindfully. As a effect, you lot tin can build a more robust credit profile and access the loans you need at the interest rates you want.

Sources

- CNBC. "22% of millennials used their stimulus bank check to pay off credit card debt—here's how that could improve your credit score", due south://www.cnbc.com/select/paying-off-credit-card-debt-boosts-credit-score. Accessed September 8, 2021.

- CNBC. "Here's how much you should really spend on your credit bill of fare to get the best credit score", https://www.cnbc.com/select/how-to-go-the-all-time-credit-score. Accessed September viii, 2021.

- Equifax. "How Long Does Information Stay on My Equifax Credit Study?", https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-study. Accessed September 8, 2021.

- Consumer Reports. "More Than a Third of Volunteers in a Consumer Reports Study Found Errors in Their Credit Reports", https://www.consumerreports.org/credit-scores-reports/consumers-found-errors-in-their-credit-reports-a6996937910. Accessed September 8, 2021.

- CNBC. "Here's how many credit cards people with excellent credit scores have," https://www.cnbc.com/2018/07/xi/how-many-credit-cards-should-you-accept.html. Accessed October 25, 2021.

Lauren Bringle is an Accredited Financial Counselor® with Cocky Fiscal – a financial technology company with a mission to aid people build credit and savings. See Lauren on Linkedin and Twitter.

Source: https://www.self.inc/blog/how-much-will-credit-score-increase-after-paying-off-credit-cards

0 Response to "what happens to my credit score when i pay off my credit cards"

Enregistrer un commentaire