what to do if you lose your paypal account

Note: If you have any questions subsequently reading this and the several other articles relating to PayPal on this site, delight leave a annotate or contact PayPal straight. Unfortunately, due to time constraints, I am unable to offer any advice over email and then all emails I receive that are related to PayPal volition remain unanswered.

Choosing a PayPal account construction is not straightforward fare for well-nigh people, so in this post, I'll attempt to demystify the whole procedure of signing upward with PayPal and choosing an business relationship type.

Before we first, a quick note:

If you are looking to send money as cheaply as possible then Wise is unremarkably going to be cheaper than PayPal.

Wise does not make money off the exchange charge per unit and just charges a small percentage of the overall transfer every bit its fee.

Accept a look at my comparison between PayPal and Wise Borderless as well as my full review of Wise Borderless. N26 and Revolut might also be good options depending on your needs.

Send money using Wise

Now back to PayPal accounts.

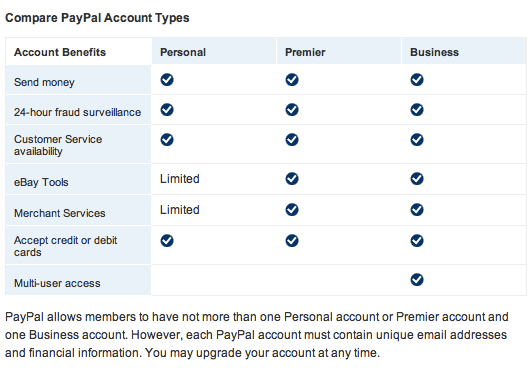

You offset out with a Personal account, simply you can so upgrade to Premier or Business accounts.

PayPal offers two different account types; PayPal for your personal utilize (Personal and Premier), and PayPal for your business (Business). It's free to sign upwardly and each account blazon offers unlike features and capabilities. To determine which ane is correct for y'all, read on.

An account for personal apply is ideal if you shop online. You can:

- Shop on eBay and merchant websites using your credit card, debit menu or bank account

- Send and receive money from friends and family unit

- Accept debit card, credit card and bank business relationship payments for a low fee when you sell on eBay and/or on your own website

Make the right choice for your online business. With a Business account you tin can:

- Accept debit carte du jour, credit card and banking company business relationship payments for a low fee

- Operate in your company or business organisation name

- Manage Users, allowing you to give separate access rights to each of your employees

- Consult the Business organization Setup guide

Buying Crypto with PayPal

Did you know you tin now purchase crypto with PayPal? That's right, y'all tin can use Binance or eToro since they both take PayPal deposits. Just hit the links below to become started.

You can also read my total review of Binance to learn more about this crypto commutation.

Buy Bitcoin with Binance

You tin can also read my total review of eToro to learn more than nearly this platform.

Purchase Bitcoin with eToro

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

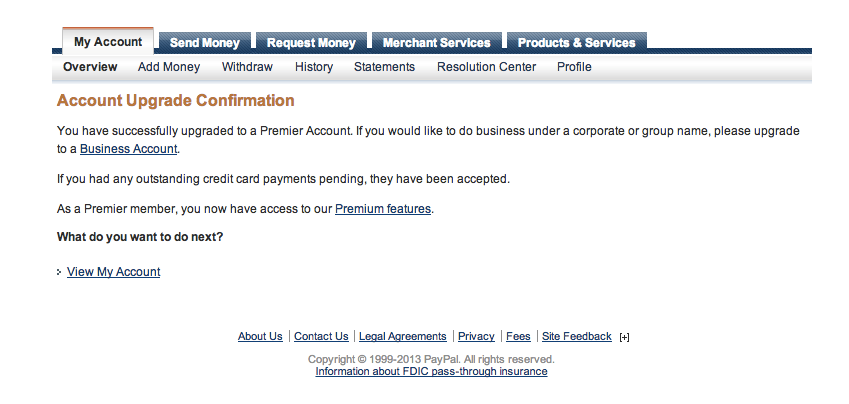

If yous decide to go ahead with the upgrade, you'll get this confirmation screen:

There is no skillful reason to have a Premier business relationship if you are going to employ PayPal for business. The fees are similar to or same as Business but some of the features not available.

- You don't demand to accept a properly registered "business organisation" to take a Business concern account. It can exist a DBA ("doing business as").

- Yous tin accept several Business accounts (only remember that each 1 should be linked to a different bank business relationship/credit bill of fare).

- At that place are no monthly fees for whatsoever of the accounts.

- Boosted services toll $35/month for all of them. Yous need to get approved to get them. You may get approved for one merely not the other.

- Additional services include:

– Website Payment Pro (allows yous to link PayPal to a shopping cart and charge credit cards without taking your customer to PayPal).

– Recurring Payments

– Virtual terminal (may exist handy if you run alive events or work with offline clients).

- If yous take various ventures and want to have a separate PayPal account for each i, at present y'all can set up a "child" account that is linked to your main ane. The do good is that the coin will be swiped from it daily and put into your parent 1 automatically and with no fees involved. Too, you lot don't need to link a kid account to a bank account. To fix a child account, create a new PayPal account then call PayPal on the phone and inquire them to link the new account to your primary PayPal account.

The concise comparing:

- Personal: Recommended for individuals who shop and pay online.

- Premier: Recommended for coincidental sellers or non-businesses who wish to get paid online, and who also brand online purchases.

- Business: Recommended for merchants who operate under a company/grouping name. It offers additional features such equally allowing upward to 200 employees limited access to your business relationship and client service email alias for customer issues to be routed for faster follow-ups.

Since my business is based in Republic of malta, I'll be describing the PayPal fees for this situation. Other European countries should have similar fees, only do cheque the PayPal website for your country for more than accurate details.

Click this link to cheque the standard rates for receiving and sending money with PayPal.

The standard charge per unit for receiving payments for goods and services is 3.4% + 0.35 EUR.

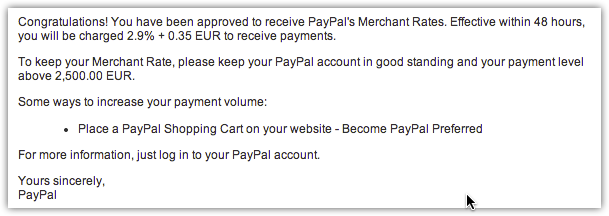

If you receive more than 2,500.00 EUR per month, yous're eligible to apply for PayPal'due south Merchant Rate – which lowers your fees as your sales volume increases. Your fees can exist equally depression as one.9% + 0.35 EUR, based on your previous month'south sales volume. For receiving money for product or service sales at the merchant rate, these are the prices:

| Monthly Sales | Price Per Transaction |

|---|---|

| €0.00 EUR - €2,500.00 EUR | three.4% + €0.35 EUR |

| €ii,500.01 EUR - €10,000.00 EUR | 2.9% + €0.35 EUR |

| €10,000.01 EUR - €50,000.00 EUR | 2.7% + €0.35 EUR |

| €50,000.01 EUR - €100,000.00 EUR | ii.4% + €0.35 EUR |

| > €100,000.00 EUR | one.9% + €0.35 EUR |

Hither's the e-mail you go subsequently y'all apply (manually) for the Merchant Rate:

Note that the rates in the table in a higher place are for domestic transactions. If y'all take customers offshore then you will incur what is known as a cantankerous-border payment accuse.

See also: Understanding PayPal Cross Border Fees

Click here to view the college cantankerous-border transaction fees. You will still do good from lower rate bands with cross-edge payments once you apply successfully for the Merchant Rate.

The accounts we've mentioned till now don't have any monthly fee, but PayPal as well offers the PayPal Pro solution, which costs $30 per month.

See likewise: Should you withdraw from PayPal to a credit carte or to a bank business relationship?

The Pro solution is for heavy PayPal users, and allows y'all to benefit from lower rates amidst other services. Click this link for more information about Pro. Become for Pro if you need full payment gateway functionality, as this organisation will allow you to create a fully customized checkout procedure that volition enable customers to complete the purchase from your site rather than being transferred to PayPal equally is the standard process.

Here's Pro in a nutshell:

- $30.00 USD monthly

- No set-up fees

- No cancellation fees

Transaction feesone.9% to 3.4% + 0.35 EUR

Choosing a Checkout Service

If you are using PayPal to collect payments for products and services that you are selling online, you volition also need to choose a checkout service. All eastward-commerce solutions such equally Shopify, WooCommerce, and Like shooting fish in a barrel Digital Downloads will allow y'all to select one out of several e-commerce checkout business solutions offered past PayPal.

Run into also: Should you open up divide PayPal accounts for each of your eastward-commerce stores?

The choice is betwixt the following:

- PayPal Website Payments Standard

- PayPal Limited Checkout

- PayPal Payments Pro

Read my separate post virtually the pros and cons of each and then decide accordingly

Managing Multiple Currencies

You can choose what currencies to accept and how you would similar to have them. When a buyer sends a payment in a currency you lot hold, the money will automatically appear in your account in that currency. When a heir-apparent sends a payment in a currency you don't hold, yous tin:

- Open a new currency residue to have the payment.

- Convert the payment to a currency yous practice accept.

- Block the payment.

You can cull a master currency as the ane you lot utilise most often for sending and requesting payments. It's also the currency that is used for your withdrawal limits.

If y'all catechumen a payment into your primary currency, PayPal offers conversion rates that are pretty bad. You tin read my guide on PayPal currency conversions for more information about that. Y'all can always preview conversion rates on currencies y'all don't hold before accepting payments.

You lot might also want to alter your PayPal withdrawal currency before you lot withdraw money to your credit card.

An Case

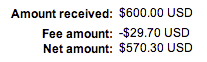

Then how do PayPal transactions expect? Let's say I take a client from the United states and charged him $600 for some web services I rendered. When he pays me via PayPal here'southward what I run into in my business relationship:

Now what's important here is to know exactly what that $29.70 fee stands for. Since this is a cross-edge payment (US to Malta), it can exist broken downwards every bit follows:

- Base fee (three.twoscore% + $0.30 USD) = $twenty.seventy USD.

- Cross-border fee consisting of a stock-still (0.50% and ane.00% depending on between which countries the transfer is made) = $3.00 USD and $6.00 USD respectively.

As an boilerplate, exist prepared to pay around five% in transaction fees for every offshore payment you receive via PayPal.

If I remember correctly, with a Personal business relationship you lot can accept or deny payments. Before you accept the payment, you tin see the estimated transaction fee on the 'Transaction Details' page. If you deny the payment, the fee is not charged. With a Premier or Concern account, at that place is no such option to accept or deny payments.

Refunds

When yous issue a refund, you don't lose any coin and the purchaser gets all his money dorsum. Click here to see the total refund policy together with a worked-out example of how refunds piece of work.

PayPal has recently changed its policy, stiffing sellers, unfortunately.

Withdrawing funds from PayPal

Not all countries offer the same facilities for withdrawing funds from Paypal. For example, in my home land Malta, we used to be able to withdraw money merely to a credit, debit, or prepaid carte du jour as well equally a US banking concern account, but no local accounts.

This was then changed to allow withdrawals to EUR based local accounts, but different with other payment providers, nosotros are not able to withdraw to local accounts in other currencies. This is a big disadvantage if yous are making most of your sales in another currency such as USD.

So right now I have to take all USD being converted automatically past my bank to my carte du jour's currency which is ever EUR by default since we're based in Malta.

Read the following posts on this topic equally it is disquisitional that you get this right:

- Withdrawing from PayPal to online banking company accounts like Wise or Revolut

- How to change PayPal's withdrawal currency for credit cards

Paypal provides a handy checker where you can select your state and meet which withdrawal options are bachelor for that land.

What about PayPal Alternatives?

At that place are many PayPal alternatives, two of which are Payoneer and Stripe.

Payoneer

It's worth looking at some PayPal alternatives that might be better suited to your needs. I've already mentioned TransferWise earlier in this article, but Payoneer is another widely used PayPal alternative, especially in Republic of india.

Launched in 2005 and headquartered in New York, Payoneer is a payment services provider that allows users to send and receive coin online. The platform currently services more than 4 million customers located in more 200 countries.

Cantankerous-currency transactions cost in the region of 2% higher up the mid-market rate, although this can be lowered if you lot concur a VIP account. If y'all obtain the Payoneer pre-paid debit card, then you'll pay $3.xv per ATM withdrawal.

Payoneer is likewise a notable PayPal alternative due to its highly rated client support. You lot have the option of contacting back up via telephone, alive chat or through a support ticket. However, response times are somewhat slow over the weekend, and then you're all-time off calling them if your query is of an urgent nature.

Check out Payoneer

Stripe

Stripe is recognized worldwide every bit the near painless mode to accept credit cards online as a merchant, and it was created with developers in mind, making integrations easy. Fees are on the depression side, and you can too get the first $twenty,000 of transactions with zero fees if yous follow my method.

Further notes

Please be aware that in that location are 2 different types of payments that tin be sent using PayPal – Buy Payments and Personal Payments. With a Personal payment blazon, the sender of the payment can choose who pays the fee which is incurred. However, information technology is non free to send the payment. Either the sender or the receiver must pay. It is possible to receive personal payments to a Personal or Premier PayPal account.

If y'all are planning on receiving payments for a business you are running, you may need to upgrade your business relationship type, as a Personal account is not suitable for receiving large amounts of payments. However, if you lot are only receiving a small-scale number of payments, you are free to practise so.

In case yous are into gambling and want to make a eolith usingPaypal, y'all should be aware that the payment platform has a strict policy about casino transactions.

See also: How to modify buying of a PayPal account

It is possible to take two PayPal accounts, however only one can be for personal apply, and must be either Personal or Premier type. Information technology's non possible to take a Personal and Premier business relationship at the same time.

You lot tin can downgrade from a Concern account to a Premier business relationship, but not back downward to a Personal account.

PayPal users can accept 1 Personal account and i Premier or Business account. Each business relationship needs to take a unique e-mail address, depository financial institution account and credit card.

Hopefully, that helps to make your choice easier. If you accept whatever questions, burn them off in the comments section.

Source: https://jeangalea.com/which-paypal-account-is-best-for-you/

0 Response to "what to do if you lose your paypal account"

Enregistrer un commentaire